Investment Preferences Template

About this Configuration Guide

This guide covers setting up the Investment Preferences application template. Using this guide, you'll explore how the Investment Preferences template works.

You can use this template in combination with the Client Information and Fund Selection templates to build an account onboarding process. The Investment Preferences template lets you gather client preferences and calculate investment risk based on the risk tolerance.

TIP To learn more about the Client Information and Fund Selection templates, visit our Client Information Template and Fund Selection Template articles.

In total, this application template has nine modules. There's a schema module that stores account submissions, and six back-end API (application programming interface) modules. Five of these API modules let you create, read, update, and delete submissions in your schema module. The other API module calculates the client's suitability score. There are also two front-end admin modules. One of these modules lets you create and manage individual account submissions with a prebuilt investment questionnaire. The other module is the main front-end admin module that lets you view and update information for an individual account. This module also lets you recalculate the suitability score after making any changes to the account.

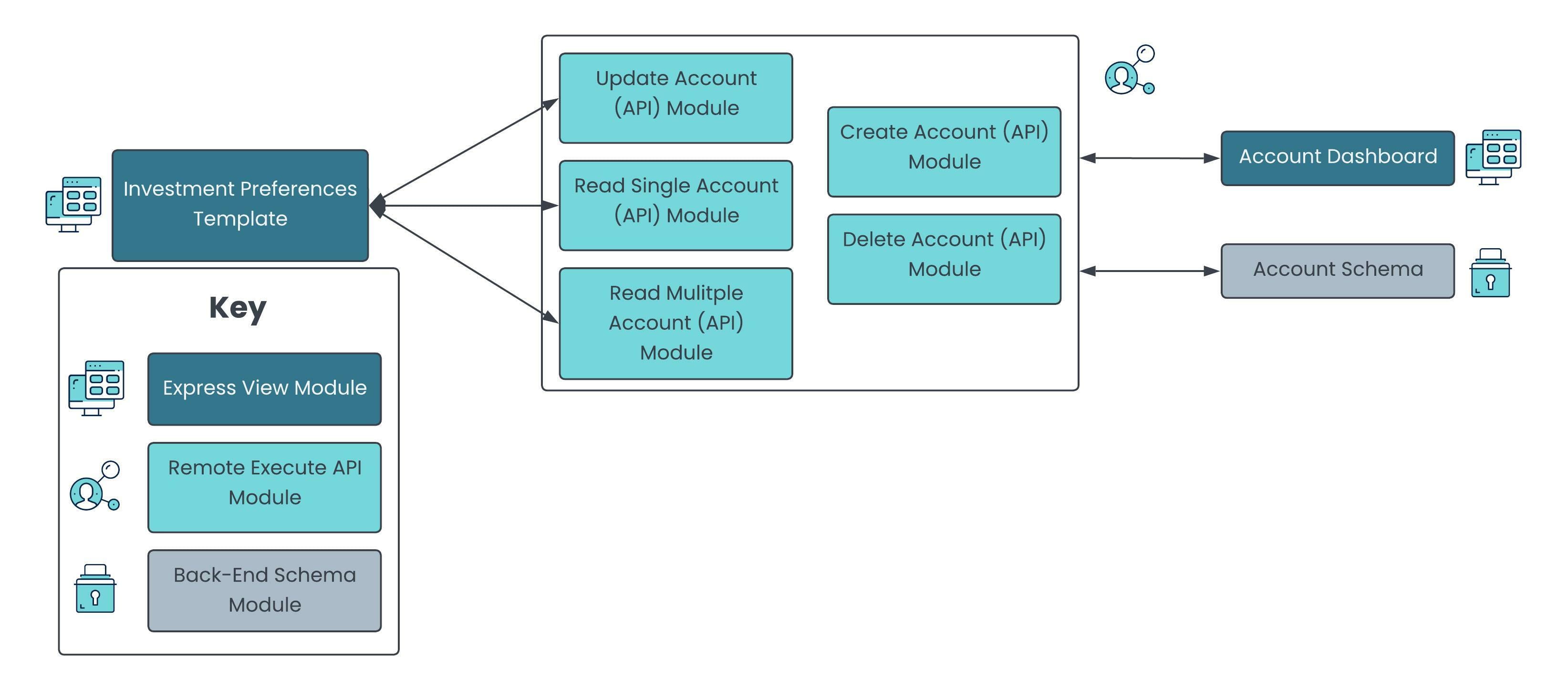

Here's a chart with the architectural layout of these modules:

Here’s a high-level overview of the modules:

| # | Module | Description |

|---|---|---|

|

1 |

Investment Preferences: Investment Preferences Template |

This front-end module lets you filter for a specific account ID, and view all preferences and risk associated. You can also update any of the data and recalculate the suitability score. |

|

2 |

Investment Preferences: Account Dashboard |

This front-end module lets you create new accounts to display on a dashboard. As configured, only account ID, account ownership, account type, and suitability score display on the dashboard. To view all client information, click the View button. |

|

3 |

Investment Preferences: Account (Schema) |

This schema module stores all account submission data. |

|

4 |

Investment Preferences: Create Account (API) |

This API module lets you create accounts and store them in the schema module. |

|

5 |

Investment Preferences: Read Single Account (API) |

This API module retrieves a specific account from the schema module so you can view it with the Investment Preferences: Account Dashboard and Investment Preferences: Investment Preferences Template modules. |

|

6 |

Investment Preferences: Read Multiple Accounts (API) |

This API module retrieves all accounts from the schema module so you can view them with the Investment Preferences: Account Dashboard and Investment Preferences: Investment Preferences Template modules. |

|

7 |

Investment Preferences: Update Account (API) |

This API module lets you edit account information and update submissions in the schema module. |

|

8 |

Investment Preferences: Delete Account (API) |

This API module lets you delete accounts from the schema module. |

|

9 |

Investment Preferences: Suitability Score Calculator(API) |

This API module calculates the suitability score when you create an account using the Investment Preferences: Account Dashboard module. This API module also recalculates a suitability score when you update account information using the Investment Preferences: Investment Preferences Template module. |

NOTE All images used in this guide are for illustrative purposes only. Images are subject to change without notice. All images are correct at the time of publication.

Overview

Add and incorporate the Investment Preferences template into an account onboarding application. You can combine it with the Client Information and Fund Selection templates to build a more robust application. This template lets you create, edit, and delete account submissions, and calculate investment risk. This template can easily integrate into a customer relationship management application to ensure your information is always up-to-date.

This application template already consists of a basic layout to get you started. All API and schema modules follow Unqork best practices so you don't have to build from scratch.

Features

With this template, you can:

-

Gather information about a client’s investment preferences.

-

Define a client’s risk tolerances.

-

Incorporate it with the Client Information and Fund Selection templates to build a robust account onboarding application.

Requirements

To use this template, you must:

-

Complete RBAC (role-based access control) setup so the right people can access your modules.

-

Have a clear understanding of your entity requirements and their relationships, if applicable.

What You'll Learn

In this article, you'll learn:

How the Template Works

The Investment Preferences template is a Module Application template.

This template has nine preconfigured modules. There's a schema module to store all account submissions and six back-end API modules. Five of these API modules let you create, read, update, and delete account schema submissions. The other API module calculates the suitability score based on the risk threshold. There's also a front-end admin module for creating accounts and displaying them on a dashboard. This front-end module consists of a questionnaire to add investment preferences. This questionnaire includes questions like investment time horizon, risk tolerance, and investment experience. Lastly, there's a main admin module that lets you view specific accounts, update information, and recalculate the suitability score.

How the Investment Preferences: Account (Schema) Module Works

This back-end module securely stores all your account submissions. All the API and front-end modules directly interact with this schema module.

This schema module contains various, prebuilt Hidden components. These Hidden components store submission data that includes the name(s) of the account owner, account type, and beneficiaries. When you customize your application, you can add or update as many parameters as you want.

How the Investment Preferences: Create Account (API) Module Works

This API module lets you create account submissions and store them in the schema module. You can create these accounts using the Investment Preferences: Account Dashboard front-end module. This front-end module comes with a button that, when clicked, opens a modal to enter information. This button has logic that calls the Investment Preferences: Create Account (API) module. This API module has an Initializer component that triggers the module's Plug-In component. The Plug-In takes the information you entered and creates a new submission in the schema module.

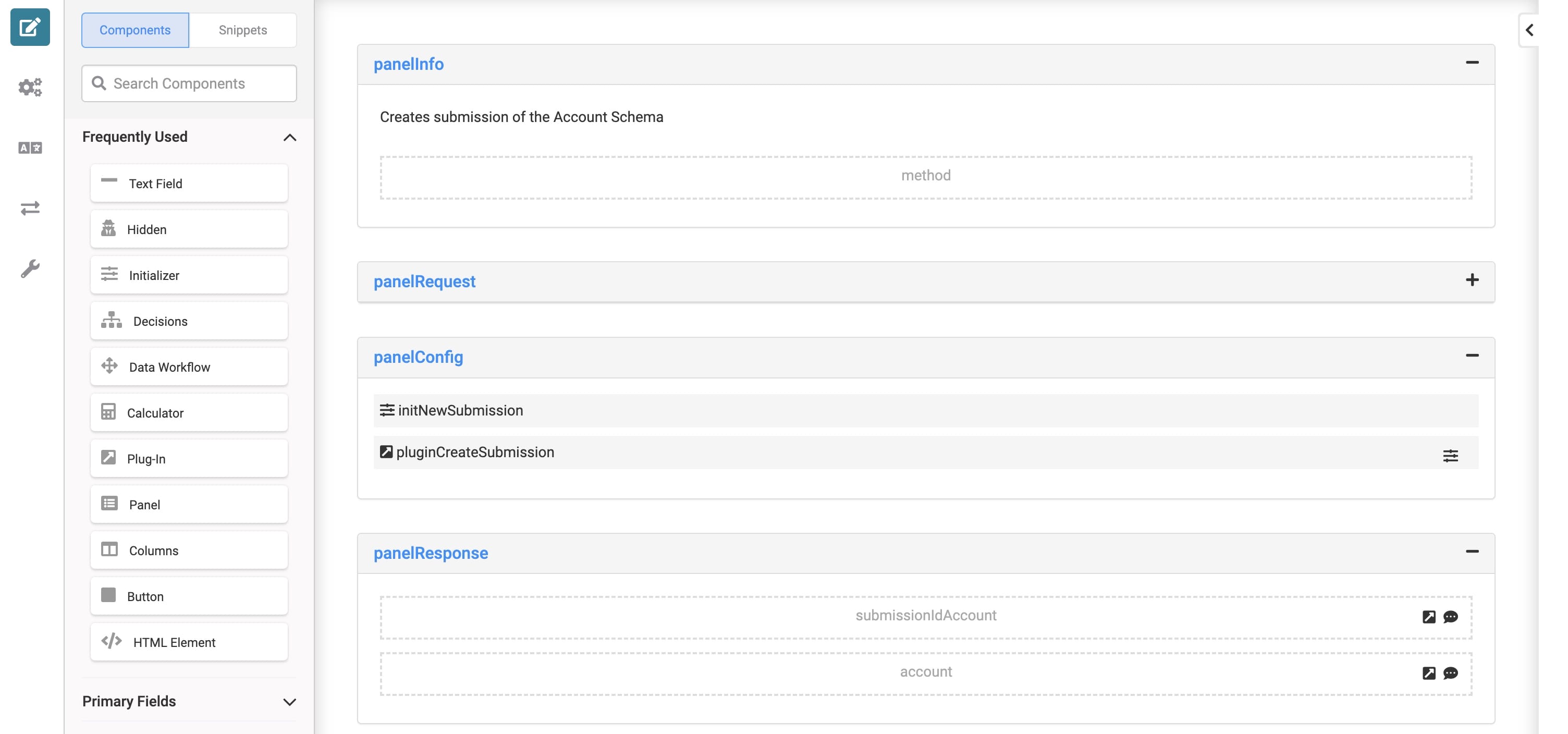

Here's how the Investment Preferences: Create Account (API) module looks in the Module Builder:

How the Investment Preferences: Read Single Account (API) Module Works

This API module lets you retrieve a specific account submission from the schema module. Click View in the Investment Preferences: Account Dashboard module to open a specific account submission. This button triggers logic that passes that schema submission's ID to the Investment Preferences: Read Single Account (API) module. This action fires the Investment Preferences: Read Single Account (API) module's Initializer, which fires the Plug-In component. The Plug-In takes the specified submission ID and retrieves the entire data object of that submission from the schema module.

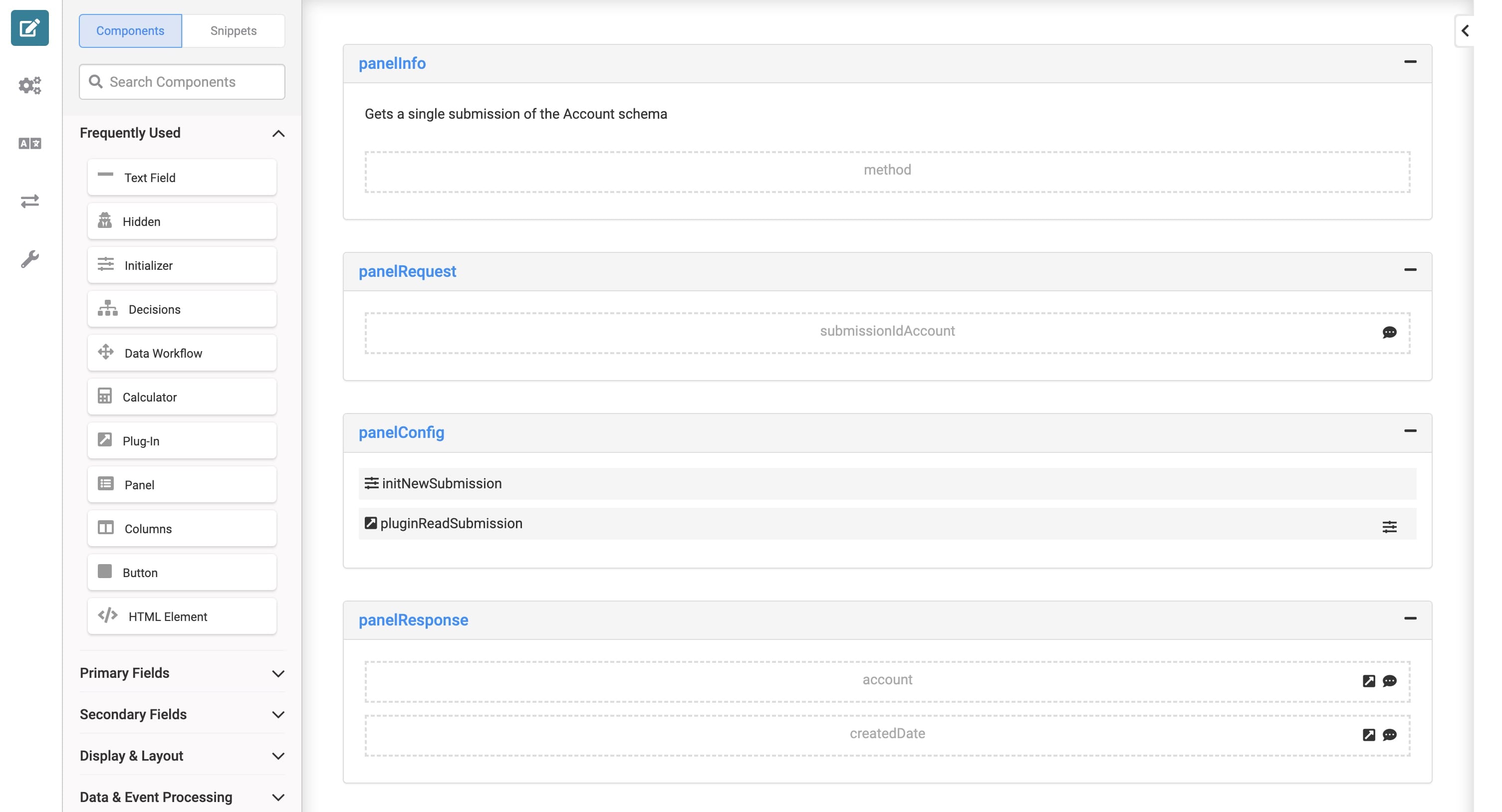

Here's how the Investment Preferences: Read Single Account (API) module looks in the Module Builder:

How the Investment Preferences: Read Multiple Accounts (API) Module Works

This module retrieves all account submissions and displays them on the Investment Preferences: Account Dashboard module. When you load your dashboard module in Express View, an Initializer fires a Plug-In component to retrieve the submissions.

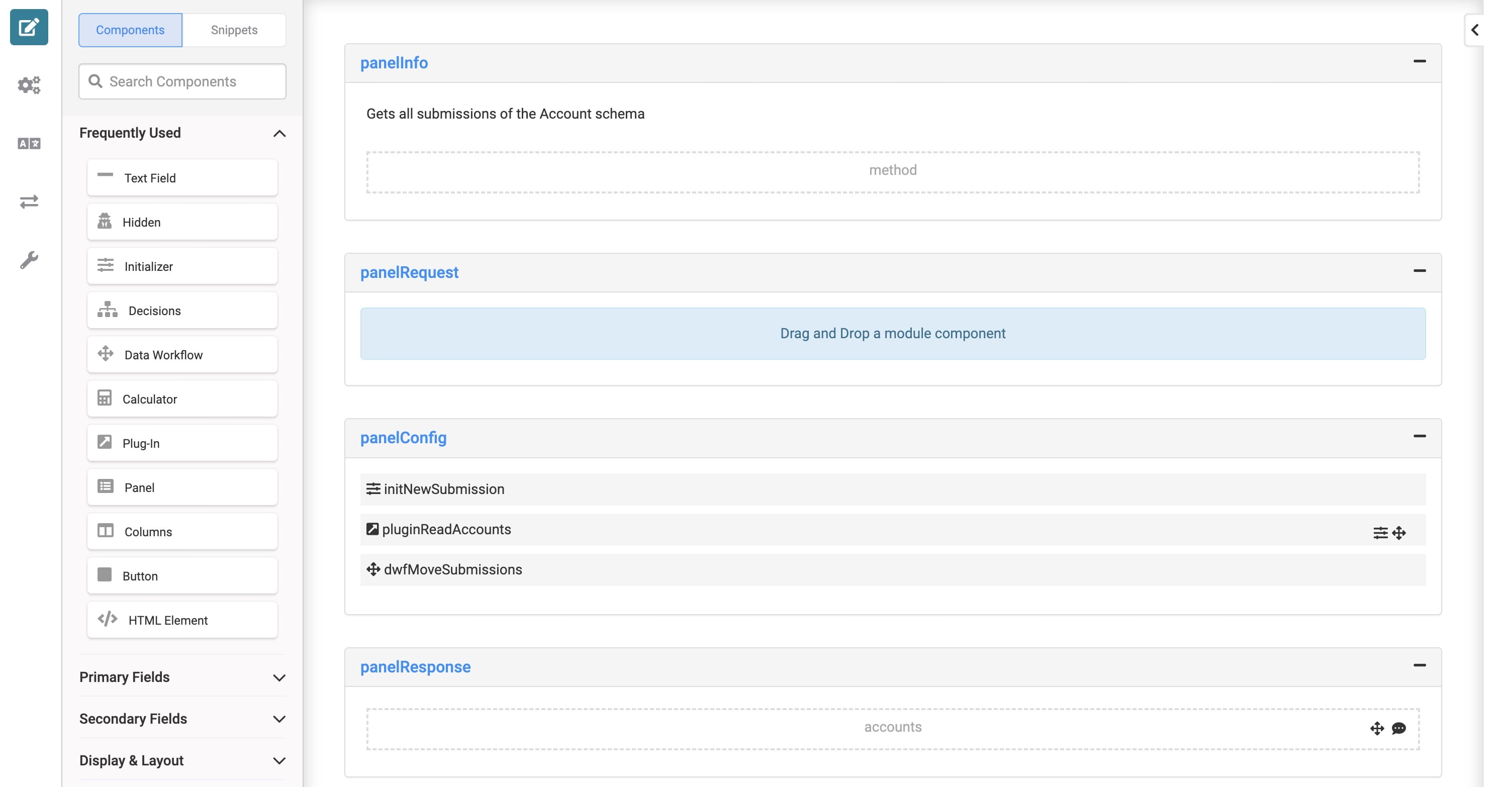

Here's how the Investment Preferences: Read Multiple Accounts (API) module looks in the Module Builder:

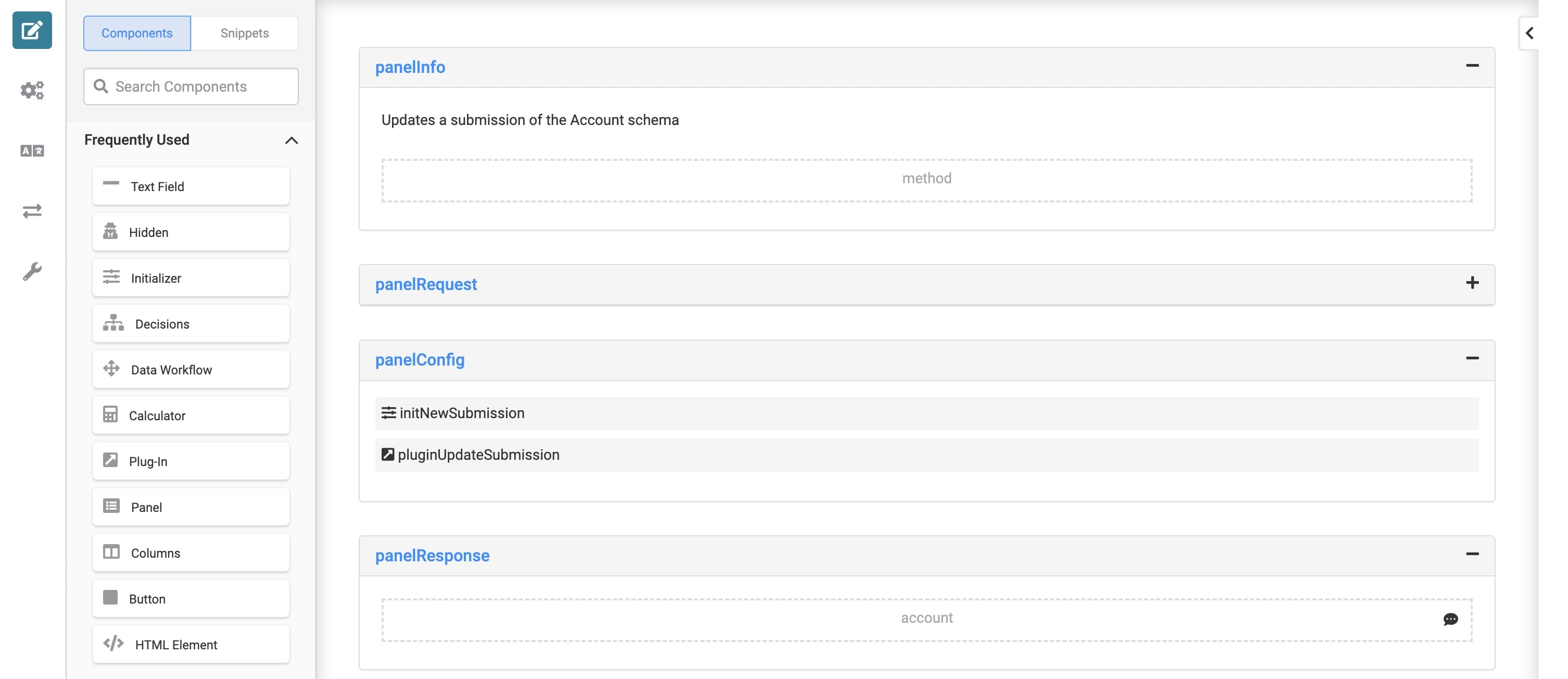

How the Investment Preferences: Update Account (API) Module Works

This API module lets you overwrite submission information in your schema module. When you click View on the Investment Preferences: Account Dashboard, an Edit Account button displays at the bottom of the modal. This button calls the Investment Preferences: Update Account (API) module. The module's Initializer fires the Plug-In component and updates the submission in your schema module.

Here's how the Investment Preferences: Update Account (API) module looks in the Module Builder:

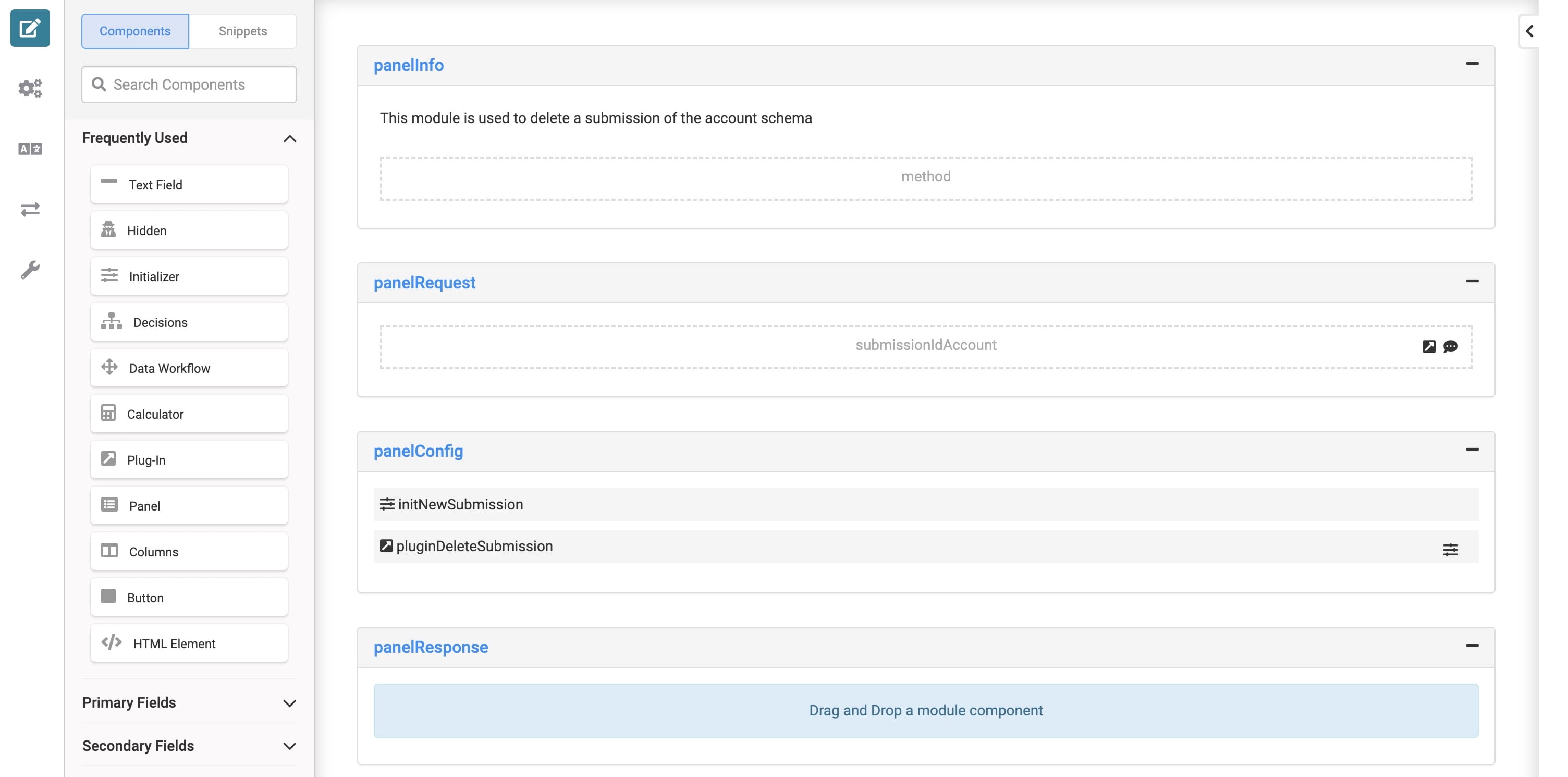

How the Investment Preferences: Delete Account (API) Module Works

This API module lets you delete submissions from your schema module. When you click View on the Investment Preferences: Account Dashboard, a Delete Account button displays at the bottom of the modal. This button calls the Investment Preferences: Delete Account (API) module. The module's Initializer fires the Plug-In component and deletes the submission from your schema module.

Here's how the Investment Preferences: Delete Account (API) module looks in the Module Builder:

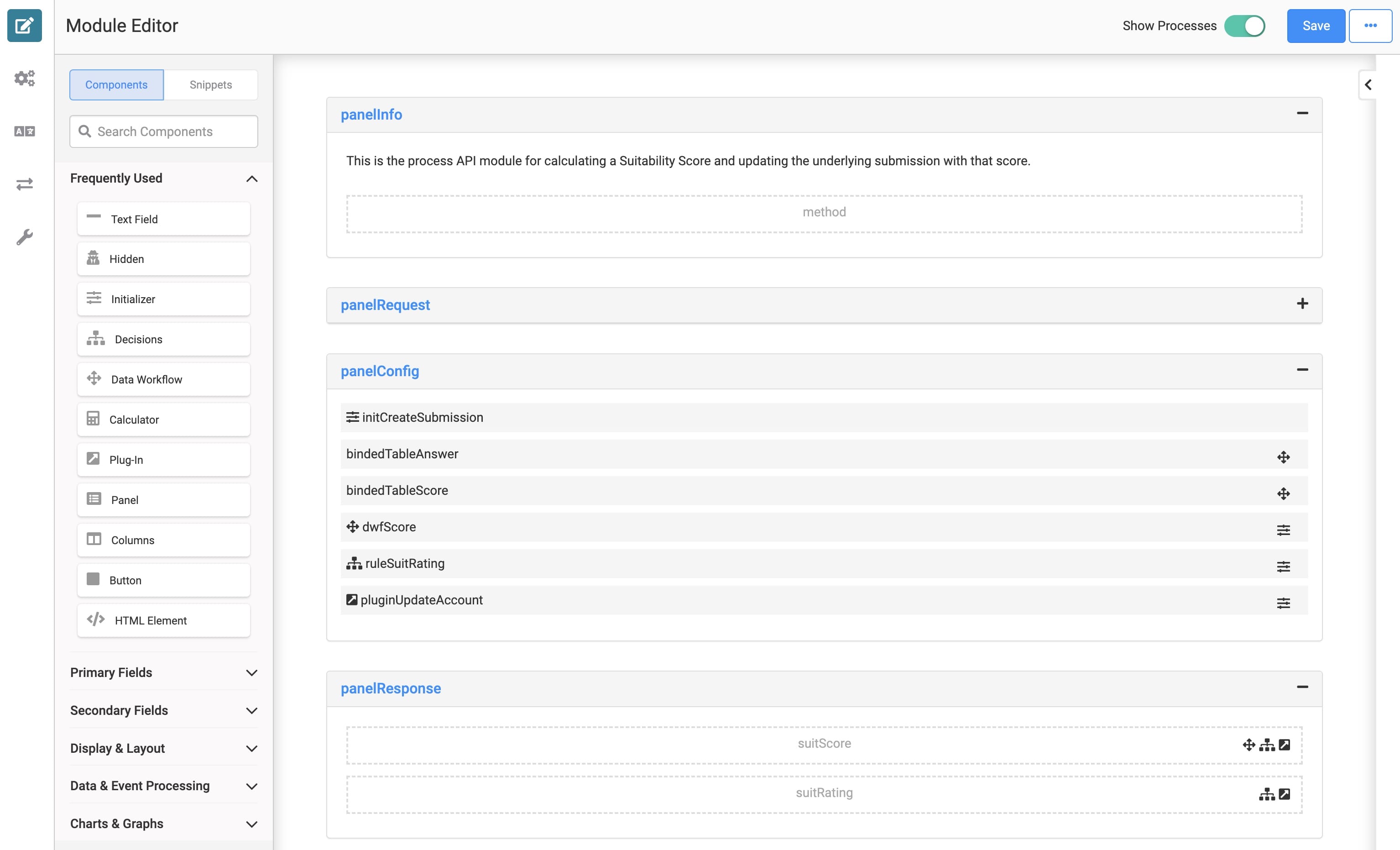

How the Investment Preferences: Suitability Score Calculator (API) Module Works

This API module compiles all the answers from the account questionnaire and calculates a suitability score. When you complete the questionnaire in the Investment Preferences: Account Dashboard module, the API module's Data Workflow merges and aggregates the values. Then, a Decisions component calculates a score based on these values and stores it in the schema module. The Investment Preferences: Suitability Score Calculator (API) module also works in tandem with the Investment Preferences: Update Account (API) module. If you select an account using the Investment Preferences: Investment Preferences Template module and update the preferences, the score gets recalculated.

Here's how the Investment Preferences: Suitability Score Calculator (API) module looks in the Module Builder:

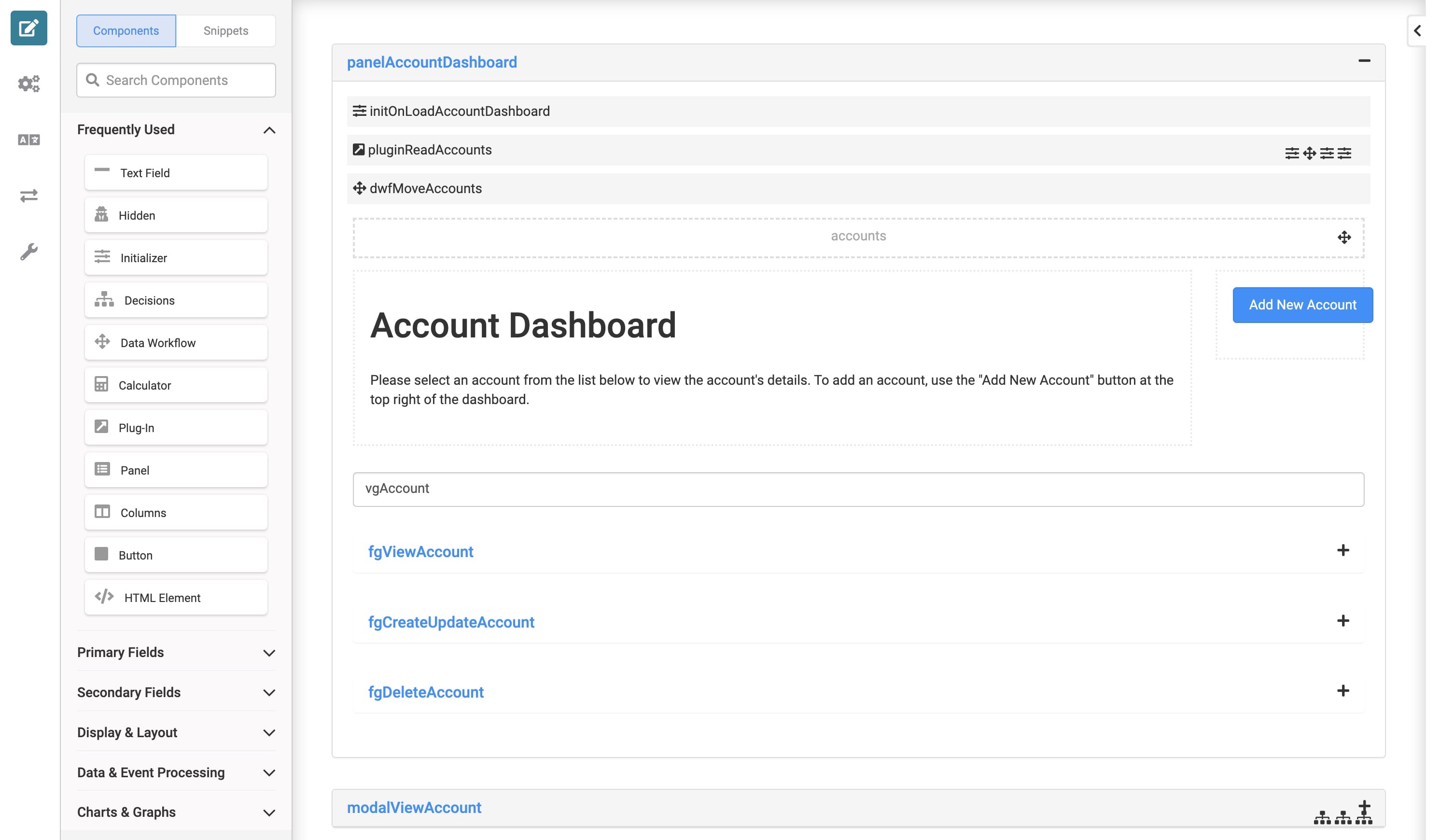

How the Investment Preferences: Account Dashboard Module Works

This front-end admin module lets you enter account information using a prebuilt investment preferences questionnaire. This module communicates with all the API modules of the Investment Preferences template. Then, those API modules connect directly to the schema module. They work together to show the most up-to-date submissions on your dashboards.

As configured, the Investment Preferences: Account Dashboard displays only account ID, account ownership, account type, and suitability score in Express View. This dashboard module lets you add new accounts using the Add New Account button. If you click View next to any account, you can view, edit, or delete submissions.

Here's how the Investment Preferences: Account Dashboard module looks in the Module Builder:

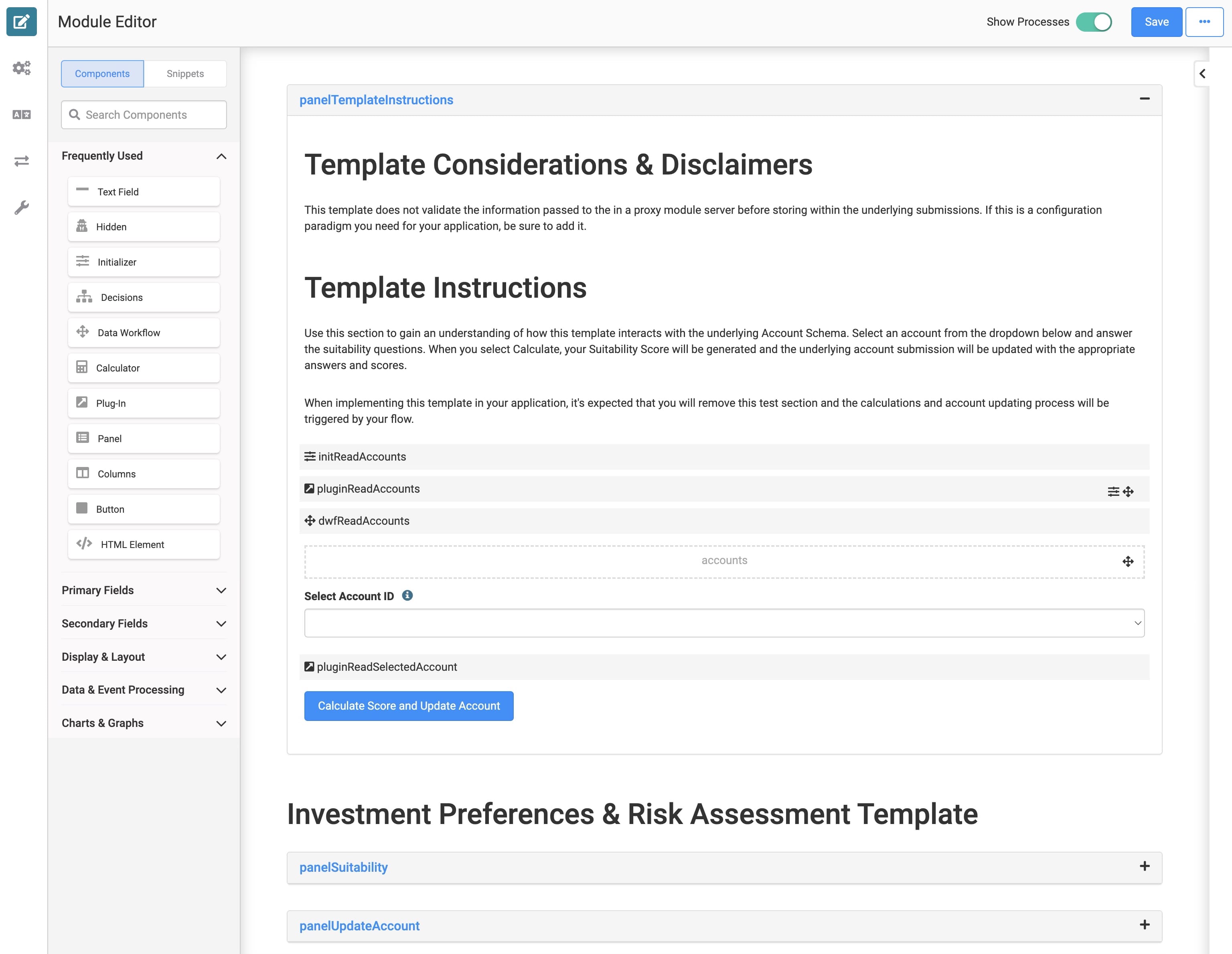

How the Investment Preferences: Investment Preferences Template Module Works

Finally, this main front-end admin module lets you filter for a specific account and display its investment preferences. This module displays all account information using various Plug-In components to trigger the read API modules. After selecting an account to view, you can make any changes to its preferences. Making a call to all the template's update API modules lets you update all account preferences with this one module.

Here's how the Investment Preferences: Investment Preferences Template module looks in the Module Builder:

Configuring the Template

Every creator's and customer's needs are different, so this application template has no preset RBAC. That way, you can configure RBAC that makes sense for you and your customers. RBAC is the most secure way to ensure users have the correct application permissions.

Most of this application template consists of back-end functionality with API and schema modules. So, ensure your RBAC settings reflect the roles you want accessing these modules.

TIP To learn more about Module Builder Settings, view our Module Builder Settings Sidebar Option article.

Customizing the Template

The Investment Preferences template is a preconfigured guide for creating an account onboarding process. You can import this module directly into your workflow or use it as a guide for your own system. You can also configure it in an application with the Client Information and Fund Selection template.

While the Investment Preferences template is functional out of the box, it's fully customizable to your needs. For instance, you might want to adjust the range and decision criteria of the Investment Preferences: Suitability Score Calculator (API) module to change and update submissions depending on your use case. You can also use the Investment Preferences: Investment Preferences Template module to ensure your configuration changes work correctly. Or, use it as your single-source admin module for making investment preference edits by account.

Resources